Reciprocal Tariffs Rattle South Africa: A Nation at a Crossroads Between Sovereignty and Survival

Trump’s 30% Reciprocal Tariffs Ignite Economic Firestorm

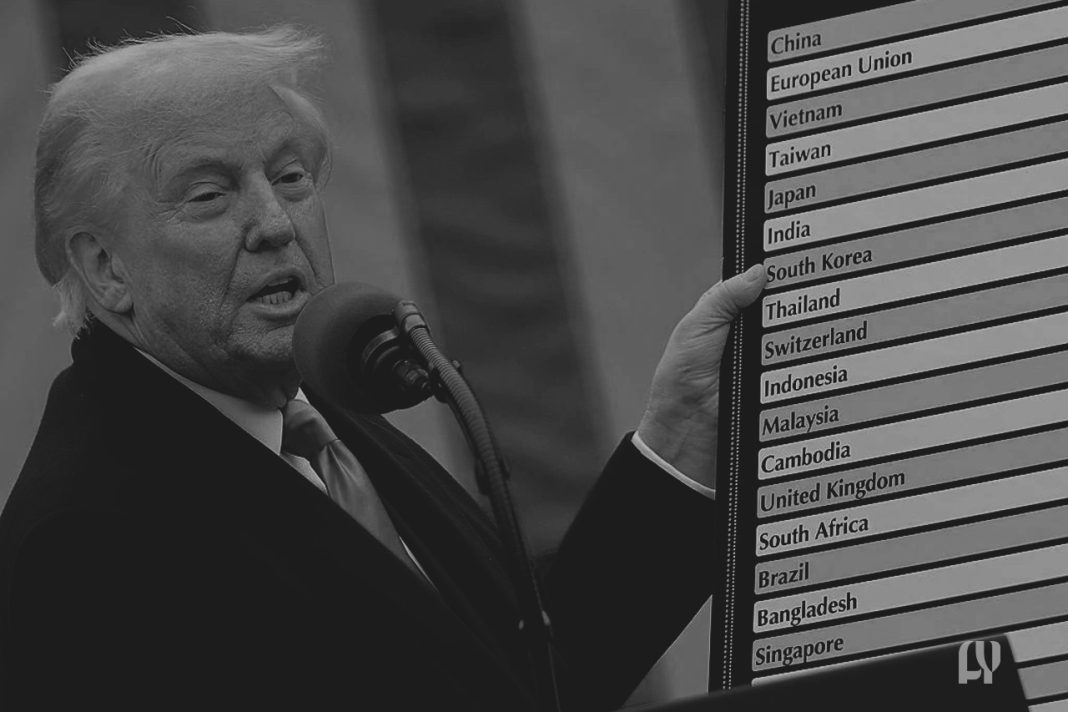

In a move that has sent shockwaves through Pretoria and Wall Street alike, former U.S. President Donald Trump announced a sweeping 30% reciprocal tariff on South African imports this week. He declared it a “fair response” to what he called “unacceptable trade imbalances.” The decision is part of Trump’s broader “America First” revival strategy. It targets key South African exports like automotive components, agricultural goods, and manufactured metals. These sectors contribute over $15 billion annually to South Africa’s GDP.

- “Wake Up Call” for Pretoria: U.S. Firms Dominate Local Economy

- AGOA in Jeopardy: Ramaphosa’s Desperate Bid for a New Trade Deal

- Farmers, Factories, and Fallout: Who Bears the Brunt?

- Diplomatic Chess: Can Pretoria Outmanoeuvre Trump?

- “Reciprocal Tariffs” or Economic Suicide? The Road Ahead

- FAQ Trump’s 30% Reciprocal Tariffs & South Africa’s Response

“The days of America being exploited are over.” Trump declared this at a rally in Ohio. He was flanked by supporters waving “Liberation Day” banners. “South Africa charges us 60% tariffs on our goods. We’re being kind by only hitting back with half.” His remarks included references to South Africa’s “anti-American alliances” with Russia, China, and Iran. These references have thrust the African nation into a high-stakes diplomatic and economic showdown.

For South Africa, already grappling with stagnant growth, tariffs threaten to derail recovery efforts. The country faces a 35% unemployment rate. Analysts warn that the levies will slash export revenues by up to $3.5 billion within the first year, risking 85,000 jobs in sectors like citrus farming and automotive manufacturing.

“Wake Up Call” for Pretoria: U.S. Firms Dominate Local Economy

Critics within South Africa are seizing the moment. They are lambasting President Cyril Ramaphosa’s administration. The criticisms focus on what they call a decade of “spineless” economic policies. U.S. entities own or control over 60% of South Africa’s retail and corporate landscape. This includes major chains like Burger King, Ford, and Amazon’s African headquarters. This dominance, critics argue, has turned the nation into a “neo-colonial outpost,” while successive governments did not negotiate fair terms.

Our government lacks the courage to demand equity. They’ve allowed American CEOs to feast while our people starve.

“The U.S. generates billions here, but where’s the reciprocity?” fumes Julius Malema, leader of the Economic Freedom Fighters (EFF), in a fiery press conference. “Our government lacks the courage to demand equity. They’ve allowed American CEOs to feast while our people starve.” Malema’s sentiments echo a growing backlash. Trade unions and grassroots movements accuse Ramaphosa of prioritising foreign investors over local empowerment.

Data from the South African Revenue Service (SARS) reveals that U.S. firms repatriated over R220 billion ($12billion) in profits from South Africain 2024 alone a figure that dwarfs the R48billion ($2.6 billion) reinvested locally. “We’re subsidising American wealth,” says economist Iraj Abedian. “It’s time to fight back with policies that emphasise South African ownership and value addition.”

AGOA in Jeopardy: Ramaphosa’s Desperate Bid for a New Trade Deal

The tariffs have also cast a dark shadow. They affect South Africa’s future under the African Growth and Opportunity Act (AGOA), a U.S. trade pact that grants duty-free access to 1,800 products. AGOA’s renewal is uncertain. Ramaphosa’s office has scrambled to propose a bilateral trade agreement. They hope to sidestep Trump’s “reciprocal tariff” ultimatum.

But negotiations will be fraught. U.S. Trade Representative Katherine Tai has already signalled demands for concessions on intellectual property rights. She also seeks Black Economic Empowerment (B-BBEE) quotas. Additionally, there’s a demand for access to critical minerals—a nonstarter for many in the African National Congress (ANC). “AGOA was a lifeline, but it came with strings,” warns Trade Minister Ebrahim Patel. “A reciprocal deal strangles our sovereignty.”

Behind closed doors, officials fear repeating Kenya’s mistakes. In 2023, Nairobi spent 18 months negotiating a U.S. trade pact only to withdraw after public outcry over demands to dismantle agricultural protections. “The U.S. doesn’t’ do mutually beneficial,” says a senior DIRCO insider. “They’ll want our markets fully open while keeping theirs restricted. Ramaphosa is walking a tightrope.”

Farmers, Factories, and Fallout: Who Bears the Brunt?

While sectors like platinum and rhodium (key for U.S. tech and defence) dodged the tariffs, farmers and automakers face ruin. The Citrus Growers’ Association estimates a R1.2 billion ($65 million) loss this season as tariffs spike from 3.5% to 30% on oranges and lemons. “We’re being punished for existing,” laments Eastern Cape farmer Thandiwe Mbeki. “Trump doesn’t care if our workers starve.”

The days of America being exploited are over.

Automotive suppliers, responsible for 6.4% of GDP, warn of plant closures in Gqeberha and East London. “The tariffs add R150,000 to each exported vehicle,” says Naamsa CEO Mikel Mabasa. “We can’t absorb that. Jobs will go first, then factories.”

Meanwhile, U.S. firms in South Africa are bracing for retaliation. Walmart-owned Massmart and Ford have quietly lobbied the State Department to soften Trump’s stance, fearing boycotts or asset seizures. “South Africans are furious,” says a Ford SA executive. “If the government grows a spine, we’ll be the first target.”

Diplomatic Chess: Can Pretoria Outmanoeuvre Trump?

Ramaphosa’s playbook now hinges on two strategies. The first is rallying African allies under the African Continental Free Trade Area (AfCFTA). The second is leveraging South Africa’s critical minerals. The U.S. is desperate to secure lithium and vanadium for its green energy transition. Pretoria hopes to negotiate exemptions for mineral exports. Washington has refused to discuss value-added exports like batteries.

“The U.S. wants our rocks, not our factories,” laments Mineral Resources Minister Gwede Mantashe. “We’ll be a quarry, not a partner.”

Opposition leaders, meanwhile, demand sharper tactics. “Sanction U.S. firms here until Trump backs down,” says Malema. “Tax their profits; nationalise their assets. Show them we’re not a colony.” But Ramaphosa, ever the pragmatist, prefers shuttle diplomacy. Special envoys, including former trade negotiator Xavier Carim, are set to meet U.S. officials in Geneva next week—a last-ditch effort to stall the tariffs before they take effect in September.

“Reciprocal Tariffs” or Economic Suicide? The Road Ahead

The rand has tumbled to R22 against the dollar. Ordinary South Africans are left wondering if there is a path out of this crisis. Economists argue that diversification is key. “We’ve relied too long on the West,” says political analyst Ranjeni Munusamy. “It’s time to deepen ties with BRICS and regional partners.”

But for now, the ANC’s survival depends on its response to Trump’s gamble. With elections looming, Ramaphosa cannot afford to look weak—nor provoke further U.S. wrath. As former President Thabo Mbeki cautioned this week: “This is no time for empty slogans. We need a strategy that blends defiance with cunning. Our sovereignty depends on it.”

One thing is certain: Trump’s reciprocal tariffs have thrust South Africa into its most precarious moment since apartheid. Whether it emerges as a sovereign victor or a neo-colonial casualty hinges on Pretoria’s next move.

FAQ Trump’s 30% Reciprocal Tariffs & South Africa’s Response

Why is South Africa’s government letting the U.S. bully us with tariffs?

Critics blast the ANC’s “spineless diplomacy”, accusing Ramaphosa of prioritising U.S. interests over local jobs. “We’re led by cowards who’d rather lick Trump’s boots than fight for our economy,” fumes EFF leader Julius Malema.

How can 60% of our economy be owned by Americans?

Decades of lax investment laws and “neo-colonial” trade deals handed U.S. firms unchecked dominance. “It’s a betrayal,” says unionist Zwelinzima Vavi. “Our leaders sold us out for empty promises and kickbacks.”

Will these tariffs destroy South African jobs?

Absolutely. Farmers and factory workers face immediate ruin, while Ramaphosa’s “urgent talks” are dismissed as theatre. “Trump doesn’t care if we starve,” snaps citrus farmer Thandiwe Mbeki. “Our government cares even less.”

Why isn’t Pretoria retaliating against U.S. companies here?

Activists demand taxing U.S. profits or nationalising assets, but the ANC fears investor backlash. “They’d rather cripple our people than upset their billionaire pals,” says #PayBackTheMoney campaigner Lukhona Mnguni.

Is AGOA’s collapse the final nail in our economy’s coffin?

Without AGOA, exports crash, but clinging to it means surrendering to U.S. demands on Israel and B-BBEE. “AGOA’s a leash, not a lifeline,” warns economist Iraj Abedian. “Wake up, or we’ll bleed out as a U.S. puppet state.”